A solution for static cash

70% of the UK’s cash is held by just nine high street banks. That’s over one trillion pounds. Flagstone helps savers (and their advisers) capitalise on new opportunities from across the market.

01.

Flagstone in brief

Benefits for your clients

02.

Benefits for you

03.

Your referral portal

04.

How the platform works

05.

Testimonials

06.

Protect and grow their cash

Flagstone – the UK’s leading cash deposit platform.

Friday, 16 February 2024

contents

The opportunity in numbers

The UK’s total household cash savings

UK savings held by households with a Wealth Manager

The average proportion of cash in the UK’s investable assets

£2tn

£884bn

15-25%

This is cash, uncomplicated.

Flagstone is the UK’s leading cash deposit platform. But, more importantly, it’s the easiest way to protect and grow your clients’ cash.��Refer your first client today.

Become a referrer

READ MORE

Become a referrer

You can find more insights and projections for the UK cash market in our latest infographic.

Become a referrer

Become a referrer

Testimonials

06.

Flagstone lets your clients open and manage hundreds of savings accounts from 65+ banks. All in one platform, with one application, and one password.

Flagstone in brief

This way, they can effortlessly:

grow their cash with competitive and

exclusive rates

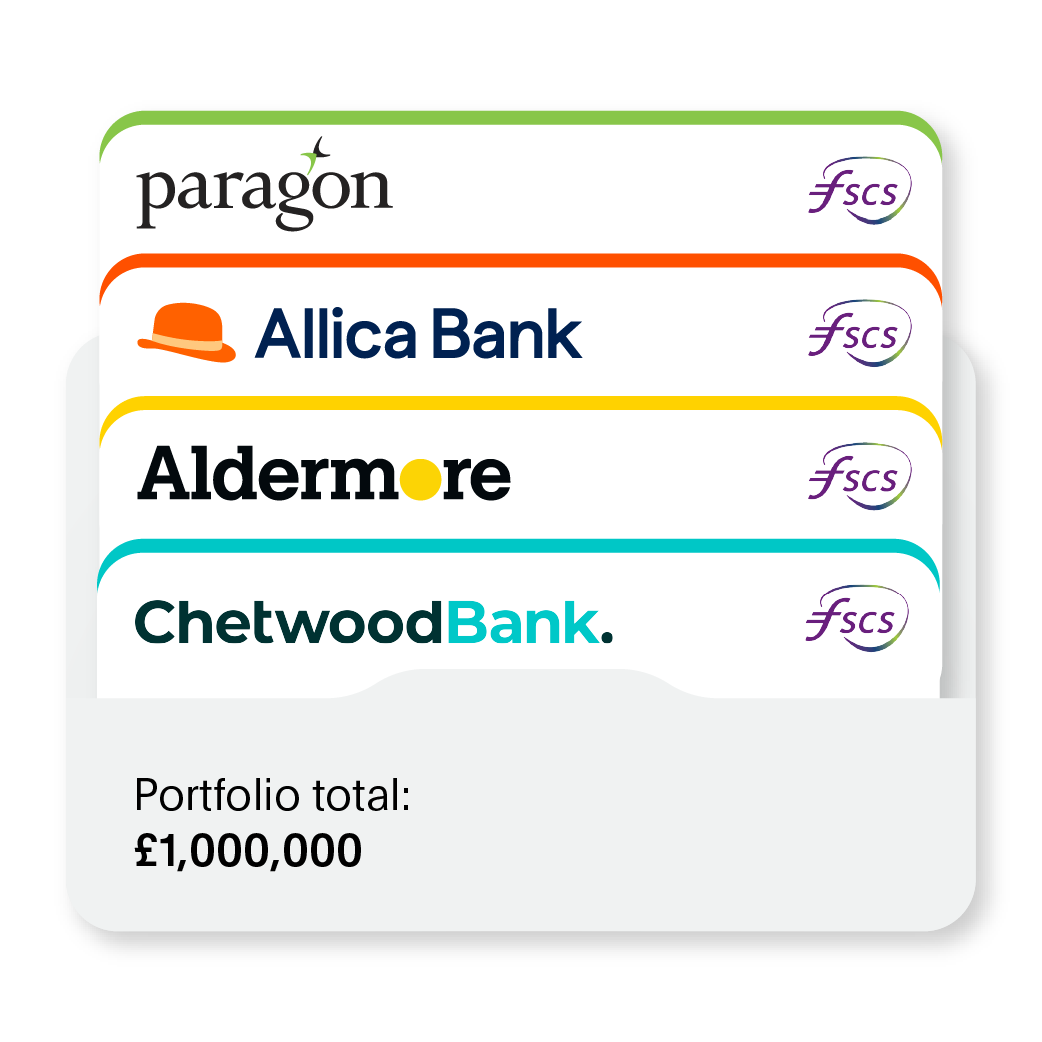

maximise their FSCS protection on eligible

deposits

escape the paperwork, with a single

application

£17bn+

75,000+

in assets under administration

clients

65+

bank partners

6,000+

Trustpilot rating

4.6/5

wealth manager partners

Flagstone for your clients

Maximise their interest

Treasures lie beyond the high street. With Flagstone, your clients can access exclusive rates from multiple banks, and keep their cash growing.

%

Fixed 15 Month

%

Notice 90 days

%

Instant access

Escape the paperwork

Hundreds of savings accounts in just one application. Flagstone offers your clients maximum choice with minimum admin.

Protect what’s theirs

With Flagstone, your clients can effortlessly open multiple savings accounts, spread their cash in moments, and maximise their FSCS protection on eligible deposits.

Account 1

£50,000

Shawbrook bank

Account 2

£40,000

Allica bank

Your Flagstone Portfolio

Split across 2 accounts

£90,000

READ MORE

Flagstone for you

Start the conversation

Not every potential client is confident with talk of stocks, bonds, and beyond. But a solution for their cash is a smooth conversation starter. Lead with Flagstone, and win more clients.

Improve their outcomes

Help your clients reach their goals faster. Whether it’s more interest or FSCS protection, greater freedom or greater peace of mind, it’s effortless with Flagstone.

See the full picture

Keep a keen eye on your clients’ entire cash portfolio, with Flagstone’s referral portal. Track every pound, and eliminate surprises.

Advise & earn

Expand your services into cash, and earn a percentage of your clients’ management fees. Or waive your share entirely, and pass more interest on to your clients. �The choice is yours.

£

Account 1

£50,000

Shawbrook bank

Account 2

£60,000

Allica bank

Your Client's Flagstone Portfolio

Split across 3 accounts

£145,000

Account 3

£35,000

The Bank of London

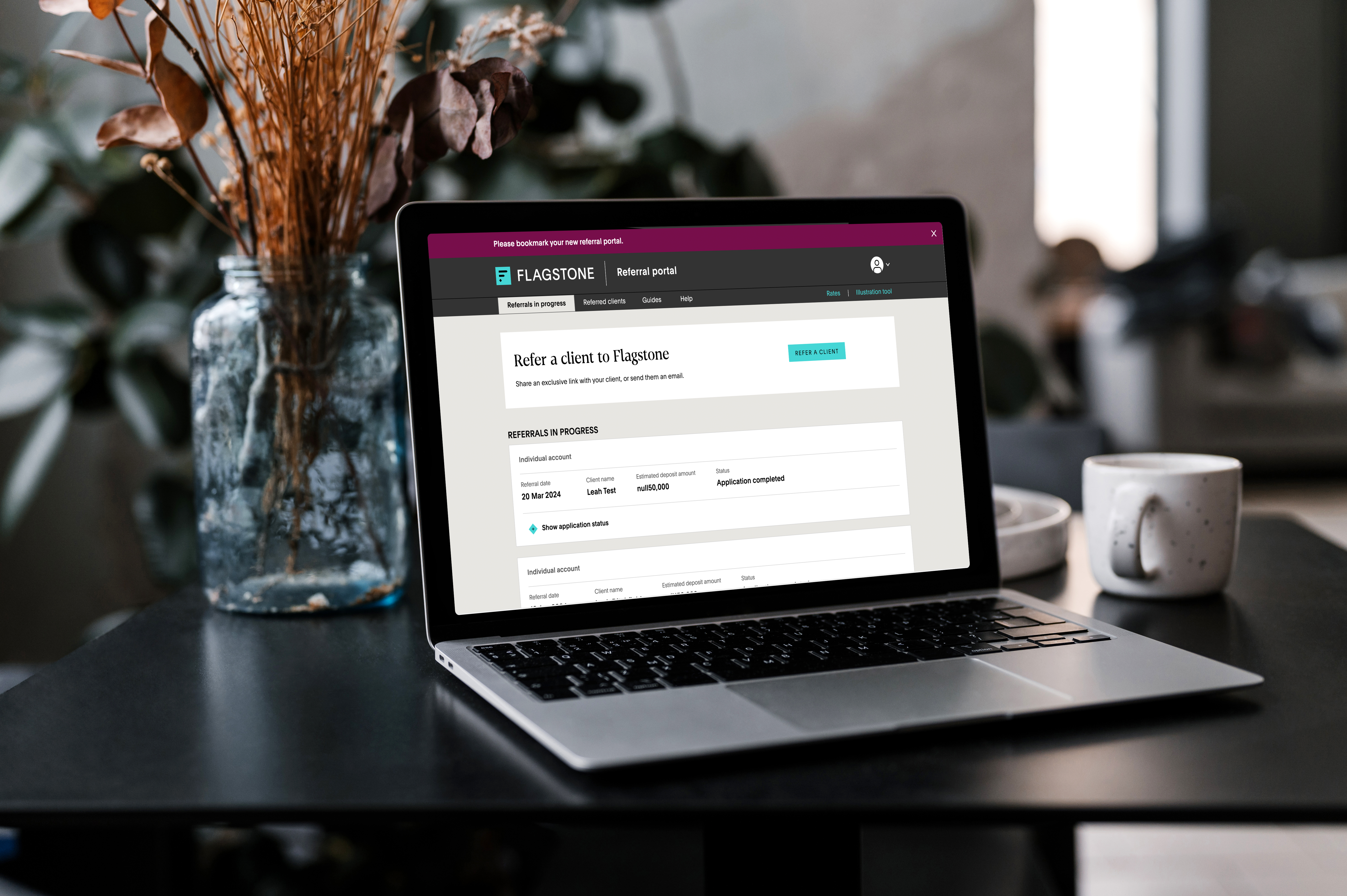

Your very own portal

Think of your Flagstone referral portal as a control centre for your clients’ cash. See everything, every day, for every client.

�No bank contact

Consolidated information

View all your clients’ savings accounts in one place, measure performance, and keep track of every pound. And get a single interest statement for their end-of-year taxes.

No banks will ever contact your client directly. So you can own the client relationship, guide their decisions, and track every action from your referral portal.

�Complete control

Timely updates

Whether it’s a new leading rate or an upcoming maturity, we’ll always notify you by email when new rates arise. So you can stay informed, and plan accordingly.

Flagstone will never advise your clients, or make transactions on their behalf. The only voice that matters is yours.

What people are saying about Flagstone

'So simple to join, excellent selection of banks to choose from, quick and reliable service. Beats all rivals.'

Brian, �Flagstone client

October 2023

Great rates which put big banks to shame.’

Paul, �Flagstone client

november 2023

'The platform allows for total flexibility. Our clients can easily access hundreds of accounts, without lengthy application processes for each individual bank. They can also open and manage various accounts in one place, saving time and hassle. ��I would recommend it to any client with cash exceeding £50,000.'

Adviser Spotlight: James Lindley, Castell Wealth Management

read more

Adviser Spotlight: �Amy Goodall-Smith, Goodall-Smith Wealth Management

read more

Adviser Spotlight: Lynne Gadsden, Grovewood Wealth Management

read more

READ MORE

J.L, �Managing Director, �Castell Wealth Management

may 2023

May 2023

Learn more about Flagstone's Cash ISA

One ISA, multiple banks

Spread ISA cash across banks in one platform.

Complete convenience

No more paperwork – never apply for a Cash ISA again.

Leading rates

We’re committed to offering rates that beat the high street.

End ISA admin

Clients can open multiple tax-free accounts in moments, move money in a few taps, and never apply for another ISA again.

Consolidate scattered cash

Bring all their Cash ISAs under one roof, and see all their savings in one place. No more ISA overwhelm.

Earn more with high-interest accounts

We're committed to offering above-average rates. So their ISA can earn the interest it deserves.

Diversify & protect your savings

Effortlessly spread their cash between 10+ trusted banks, all in one ISA. For maximum FSCS protection (up to £120,000 per banking group).

Transfer in, fee-free

Clients can move as many ISAs into Flagstone as they like, with no transfer charges.

Withdraw flexibly

They can fund and withdraw in the same tax year without it affecting their annual tax-free allowance.

How the Flagstone Cash ISA works

Key benefits

In the past, each ISA your clients opened would typically sit with a single bank. But with the Flagstone Cash ISA, they can spread funds between multiple banks in the same tax-free wrapper – and move money in moments when new rates arise. All with one sign-up.

Understanding how their Cash ISA is managed

FAQs

As the name suggests, clients will manage their Flagstone Cash ISA through our easy-to-use platform. But the FCA-regulated ISA provider is WealthKernel, one of our trusted partners.

Neither Flagstone nor Wealth Kernel will ever have control over your clients’ cash – we hold their deposits in trust, so they’ll always be the sole owner. We’ll only ever move money at your clients’ request, on their behalf. They’re always in total control.

Is the Flagstone Cash ISA flexible?

Will clients see their ISA allowance on the platform?

Can clients access a separate ISA statement?

How long does it take to transfer an ISA to Flagstone?

Yes – clients will be able to withdraw and replace funds within the same tax year without affecting their allowance.

Yes – we’ll clearly display their remaining allowance. We can only calculate this based on any funds they’ve deposited through Flagstone – it doesn’t cater for any deposits through other platforms.

Yes – they’ll receive distinct statements for ISA and non-ISA accounts.

We expect to complete transfers within 15 working days for Cash ISAs, or within 30 calendar days for stocks & shares ISAs.

Questions

Answers

Consolidate clients’ scattered Cash ISAs, with Flagstone.

If your clients have built a collection of Cash ISAs, inconvenience is guaranteed. Multiple platforms. Forgotten passwords. Weekend work. But the Flagstone Cash ISA puts an end to the admin. Read on to find out how.

The end of ISA admin.

READ MORE

Consolidate scattered Cash ISAs with Flagstone.

The end of ISA admin.

READ MORE

One ISA, multiple banks

Spread ISA cash across banks in one platform.

Complete convenience

No more paperwork – never apply for a Cash ISA again.

Leading rates

We’re committed to offering rates that beat the high street.

How the Flagstone Cash ISA works

In the past, each ISA you opened would typically sit with one bank. But with the Flagstone Cash ISA, you can spread funds between multiple banks in the same tax-free wrapper – and move money in moments when new rates arise. All with a single sign-up.

End ISA admin

Open multiple tax-free accounts in moments, move money in a few taps, and never apply for another ISA again.

Consolidate scattered cash

Bring all your Cash ISAs under one roof, and see all your savings in one place. No more ISA overwhelm.

Why open a Flagstone Cash ISA?

Earn more with high-interest accounts

We're committed to offering above-average rates. So your ISA can earn the interest it deserves.

Diversify & protect your savings

Effortlessly spread your cash between 10+ trusted banks, all in one ISA. For maximum FSCS protection (up to £120,000 per banking group).

Transfer in, fee-free

Move as many ISAs into Flagstone as you like, with no transfer charges.

Withdraw flexibly

You can fund and withdraw in the same tax year without it affecting your annual tax-free allowance.

Understanding how your Cash ISA is managed

As the name suggests, you’ll manage your Flagstone Cash ISA through our easy-to-use platform. But the FCA-regulated ISA provider is WealthKernel, one of our trusted partners.

Neither Flagstone nor WealthKernel will ever have control over your cash – we hold your deposits in trust, so you’ll always be their sole owner. We’ll only ever move money at your request, on your behalf. You’re always in total control.

WealthKernel is a UK-based fintech company that provides the technology and infrastructure used to support Flagstone’s Cash ISA. They supply the regulated systems that allow us to open ISA wrappers, manage ISA holdings and report activity to HMRC.

FAQs

Is the Flagstone Cash ISA flexible?

Will I see my ISA allowance on the platform?

Can I access a separate ISA statement?

How long does it take to transfer an ISA to Flagstone?

Yes – you’ll be able to withdraw and replace funds within the same tax year without affecting your allowance.

Yes – we’ll clearly display your remaining allowance. We can only calculate this based on any funds you’ve deposited through Flagstone – it doesn’t cater for any deposits through other platforms.

Yes – you’ll receive distinct statements for ISA and non-ISA accounts.

We expect to complete transfers within 15 working days for Cash ISAs, or within 30 calendar days for stocks & shares ISAs.

Questions

Answers

Consolidate clients’ scattered Cash ISAs, with Flagstone.